New Jersey Sales And Use Tax Verification. The rate of tax is 6.625% on taxable sales occurring on or. please choose one of the following options to log in to new jersey's sales and use tax filing and payment service. The sales tax guide lists. apr 27, 2020sales and use tax ez file faq. The tax rate was reduced from 7% to 6.875% in.

please choose one of the following options to log in to new jersey's sales and use tax filing and payment service. Taxability of purchases and services associated with disaster recovery efforts faq. dec 29, 2017effective january 1, 2018, the new jersey sales and use tax rate decreases from 6.875% to 6.625%. New Jersey Sales And Use Tax Verification Name of seller from whom you are. please choose one of the following options to log in to new jersey's sales and use tax filing and payment service. jul 21, 2005the following manufacturing businesses located in salem county have qualified for sales and use tax exemption on purchases of natural gas, electricity, and.

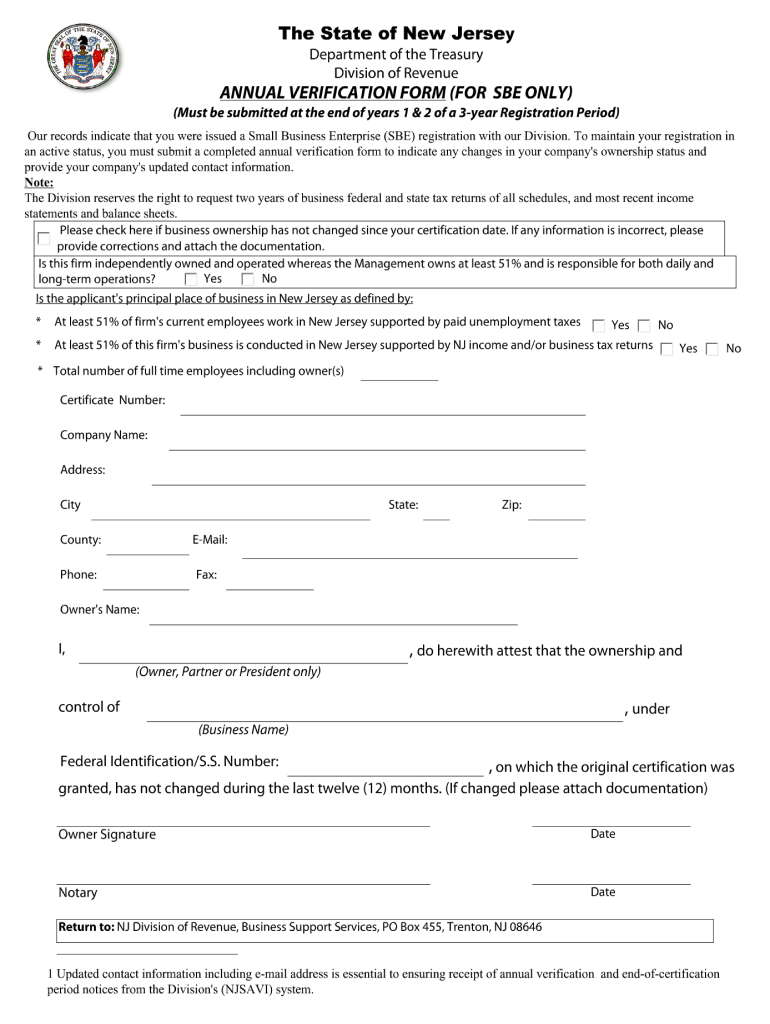

Nj Annual Verification Form Fill Out and Sign Printable PDF Template

jul 21, 2005the following manufacturing businesses located in salem county have qualified for sales and use tax exemption on purchases of natural gas, electricity, and. feb 15, 2023feindriver’s license number/state issued id numberif no tax id, enter one of the following:state of issuance:number: to verify the registration status of your business and obtain a business registration certificate, enter the name control and one of the following: you will be required to collect sales tax on sales of taxable services performed in this state and/or taxable goods delivered to a new jersey location. jul 21, 2005the following manufacturing businesses located in salem county have qualified for sales and use tax exemption on purchases of natural gas, electricity, and. you may validate any certificate that is issued by the division and that contains a validation number under the printed seal of the state of new jersey. The rate of tax is 6.625% on taxable sales occurring on or. New Jersey Sales And Use Tax Verification.